The question everyone has been asking:

WHICH IS THE BEST CREDIT CARD TO USE OVERSEAS?

Now I shall reveal the answer to you!

|

| Comparison does not take into consideration: promotions, cross border charge, forex etc |

In order of preference,

1) UOB Visa Signature (2.5% charge for transaction in forex outside SG)

- Best cash rebate at 5% for general purchases overseas.

- Joint best miles earner too at 4 miles/$ spent.

- Remember to spend a minimum of S$1000.00 in foreign currencies.

- Capped at spend of S$2000.00 or 4000 UNI$ earned.

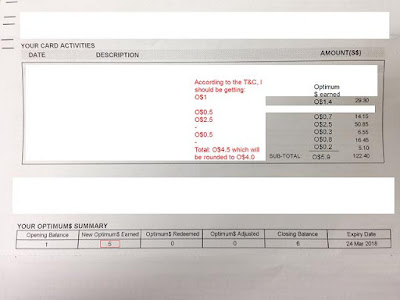

2) CITIBANK Rewards (2.5% charge for transaction in forex outside SG)

- Only for purchases in shops selling bags, clothes, shoe and major department store.

- 2.78% in cash rebates

- Joint best miles earner too at 4 miles/$ spent.

3) Standard Chartered Manhattan (3.5% charge for transaction in forex outside SG)

- 2nd in terms of cash rebate at 3%.

- Minimum of S$3000 required within statement period.

- Capped at S$6667 due to max rebate of S$200 to be earned in the period.

The above cards are chosen for their high rebates/miles and most importantly, FUSS-FREE!

TIPS:

1) Always CHARGE YOUR PURCHASES IN FOREIGN CURRENCIES.

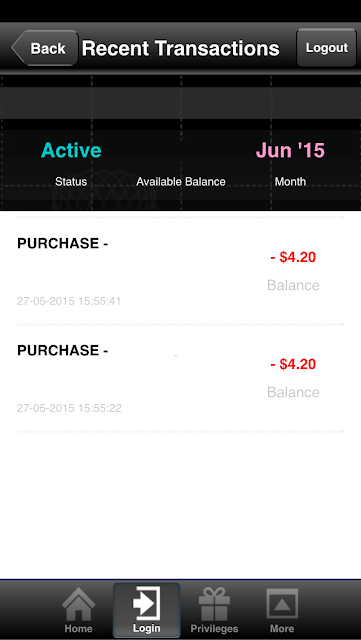

2) Always SET SMS ALERT FOR TRANSACTIONS, more than $1.00 if possible.

3) REMEMBER the BANK HOTLINE for emergencies.

4) REMEMBER to ACTIVATE YOUR CREDIT CARD FOR OVERSEAS USE before flying!

Tags: best credit card for overseas, foreign currency transaction, ANZ Travel Card, CITIBANK Clear Plat, Premiermiles, Rewards, DBS Altitude, Maybank Horizon, OCBC Titanium, Standard Chartered Manhattan, UOB PRVI, UOB Visa Signature, AMEX, VISA, MASTERCARD, miles, cash rebates, 2015, charges for transaction in foreign currencies outside Singapore.