OCBC 360 VS UOB ONE

Let's compare the PROS & CONS of the OCBC 360 account and the UOB One account.

|

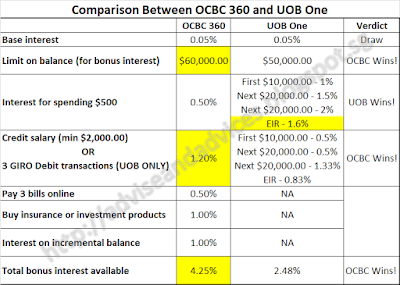

| Comparison Between OCBC 360 & UOB One |

Based on the table above, it seems like OCBC 360 wins hands down! But that's not actually the case. Unless you buy insurance or investment products from OCBC or your incremental on balance is huge, the actual interest rates for comparison is 2.25% (OCBC 360) vs 2.48% (UOB One).

Now you would think that UOB One wins! But that's not the case again.

There is ONE BIG factor that we need to consider:

How much money you have?

It all depends on how much money you have, isn't it?

Let's assume you are able to meet the basic requirements for OCBC 360 and UOB One.

(a) $500 spending

(b) Salary crediting OR 3 GIRO Debit transactions

(c) Pay 3 bills online

Bonus interest for buying insurance and investment products as well as for incremental increase in account balance will be omitted for an easier and clearer comparison.

|

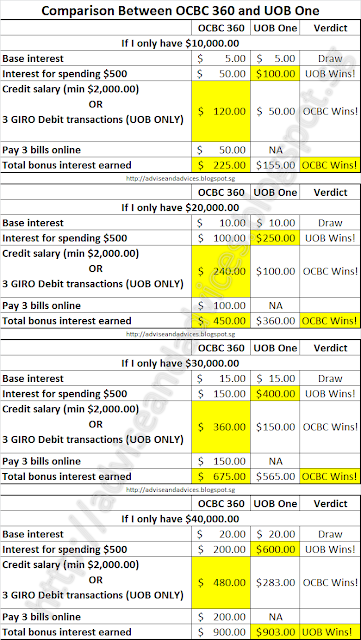

| Comparison Between OCBC 360 & UOB One |

So what happens if I have MORE money?

|

| Comparison Between OCBC 360 & UOB One |

If you have $39,735.00 or less, OCBC 360 gives you the best deal!

If you have between $39,736.00 and about $55,273.00, UOB One gives you the best deal! ( I calculated to the nearest dollar.)

If you have between $55,274.00 and $60,000.00, OCBC 360 gives you the best deal!

So, like I said, it all depends on how much money you have.

Of course, this is just a comparison based on the interest rates.

Hassle-free method of getting the best from the banks!

Tags: comparison, OCBC 360 account, UOB One account, bonus interest rates

No comments:

Post a Comment